In a significant turn of events, the US housing market demonstrated a robust recovery in February 2025, defying previous predictions of a sluggish growth trajectory. This resurgence is marked by increased housing starts, a key indicator of market vitality, which rose sharply according to the latest data. This recovery not only signals positive momentum for the housing industry but also reflects broader economic implications.

Understanding the Rebound: Housing Starts Surge

Housing starts, which denote the initiation of construction on new residential units, serve as a vital economic indicator. February 2025 witnessed a remarkable increase in housing starts, translating to more homes being built and consequently contributing to economic growth. This upswing is especially noteworthy considering the environment of uncertainty that had dominated the market in previous months.

Factors Fueling the Rebound

- Interest Rates: Historically low mortgage rates have incentivized new buyers and developers. These favorable conditions have reduced borrowing costs, making it more feasible for developers to undertake new projects.

- Government Initiatives: Stimulative fiscal policies and housing incentives have provided the necessary boost to developers and homebuyers alike.

- Demographic Demands: As millennials and Gen Z enter prime home-buying age, the demand for housing has naturally increased, prompting a need for more residential spaces.

This constellation of factors has underpinned the surge in construction activity, encouraging stakeholders across the spectrum to invest and participate in the housing market.

Regional Variations: A Closer Look

While the national figures present a promising picture, regional performances varied significantly. Certain areas experienced pronounced growth due to localized economic factors and demographic patterns.

The Role of Urban and Suburban Development

- Urban Areas: Cities rebounded aggressively as young professionals returned to the urban centers post-pandemic, attracted by career prospects and urban lifestyles.

- Suburban Expansion: Simultaneously, suburban areas saw continued growth as remote work environments fostered a desire for homes with more space and proximity to nature.

This dual growth pattern underscores the varied approaches potential homeowners and developers are taking, reflecting their evolving needs and preferences.

Implications for the Broader Economy

The recovery in the housing sector harbors broader implications for the US economy at large. The construction industry, a significant employment generator, benefits directly, potentially reducing unemployment rates and enhancing disposable income.

Positive Ripple Effects

- Job Creation: With heightened construction activity, a surge in job opportunities within the sector follows, fostering economic resilience.

- Increased Consumer Spending: As more individuals secure employment and housing, their increased spending can stimulate growth in sectors ranging from retail to technology.

- Investment Opportunities: A strong housing market often attracts investment from domestic and international investors looking for stable, long-term returns.

The potential for sustained economic growth is significant if the momentum in housing continues throughout the year.

Challenges and Considerations

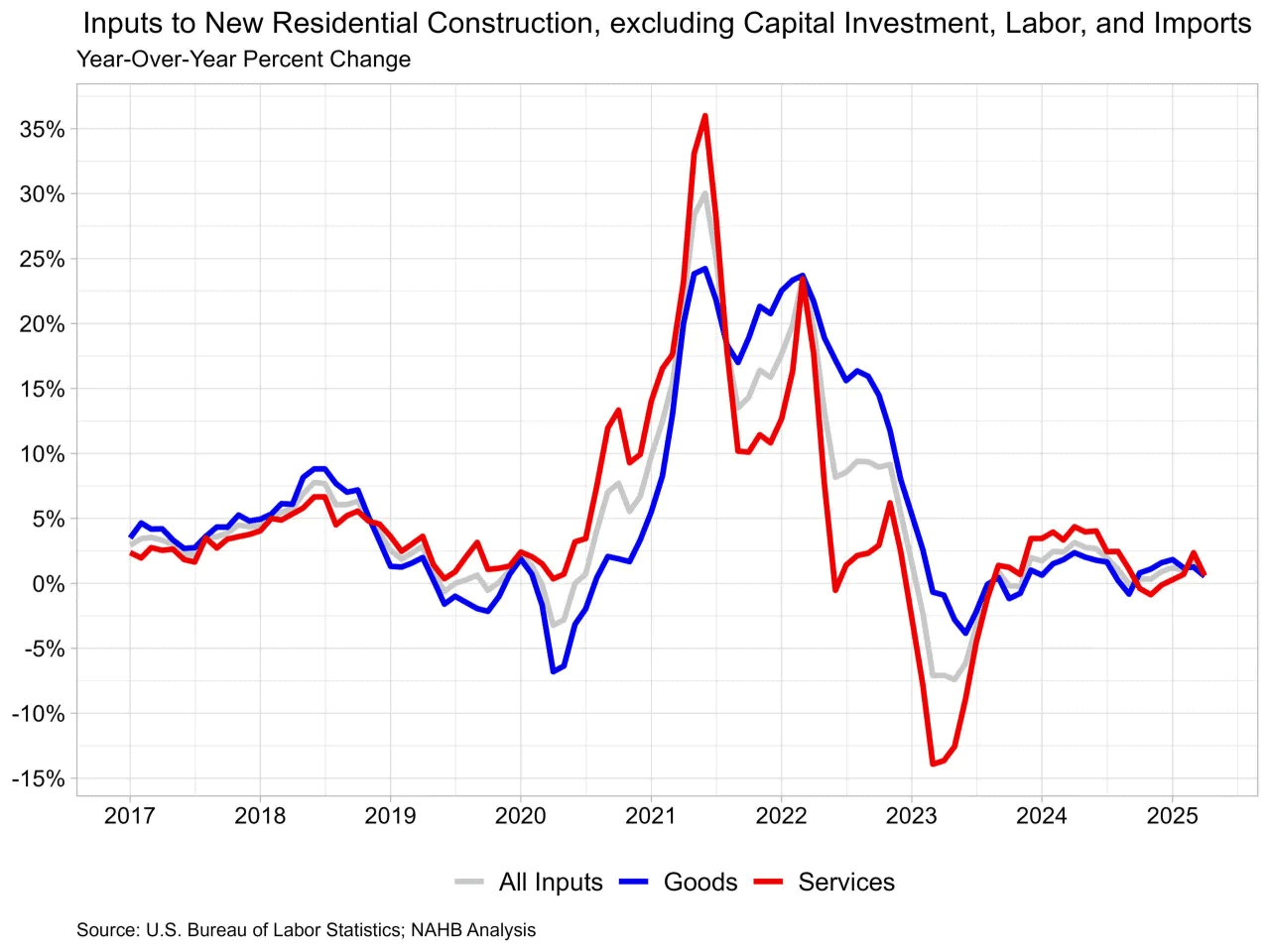

Despite the positive developments, certain challenges persist that could impact the trajectory of this rebound. These include resource shortages, regulatory hurdles, and potential changes in fiscal policies.

Managing Resource Constraints

- Material Shortages: Fluctuations in the availability of critical building materials could slow down future projects, posing a risk to continued growth.

- Skilled Labor Deficit: Ensuring an adequate pool of skilled labor remains a concern, impacting the efficiency and speed of construction.

Policymakers and industry leaders will need to address these challenges proactively to sustain and build upon the gains realized in February.

The Road Ahead: Sustainable Growth

Looking forward, the US housing market stands at an inflection point. Maintaining this upward trend hinges on balancing demand with sustainable development practices and addressing the sector’s persistent challenges.

Strategies for Future Growth

- Innovative Building Techniques: Embracing advanced construction technologies can improve efficiency, reduce costs, and mitigate resource constraints.

- Sustainable Development: Aligning new projects with green building standards can help address environmental concerns while appealing to eco-conscious consumers.

- Inclusive Policies: Ensuring that housing remains accessible and affordable to diverse income groups remains critical to sustained market health.

By focusing on these strategies, stakeholders can ensure that the February rebound in housing starts translates into a long-term recovery that supports the broader economy and meets the needs of its evolving population.

In conclusion, the US housing market’s performance in February 2025 paints an optimistic picture of recovery and growth. With careful planning and strategic initiatives, this rebound can set the foundation for a prosperous and sustainable future in housing and beyond.