A steel manufacturing business’s income depends on several factors, including raw material prices and energy costs. These prices are subject to frequent fluctuations, which can affect production costs and profit margins. Therefore, it is important to regularly monitor market trends and implement cost reduction strategies.

Steel businesses can also generate additional revenue by offering equipment rental services. This allows them to monetize their existing infrastructure and stay competitive even during periods of slow demand.

Cost-effectiveness

The steel industry is undergoing significant changes, and savvy players will know how to make the most of them. One way to do this is to add value to products by creating customized metallurgical properties. Adding value can boost profitability by improving product performance and reducing waste. This approach also reduces dependence on raw materials and other input costs.

Another way to increase profitability is by lowering energy costs. For instance, using natural gas to power production can save money by reducing carbon emissions and decreasing the need for blast furnaces. It can also provide operational flexibility to respond to changing demand conditions, reducing the risk of unplanned shutdowns.

Achieving cost-effectiveness is essential for a sustainable steel industry. Several factors can affect the bottom line, including global economic trends, trade measures, and customer expectations. Steel players must understand the impact of these factors on their products and sales markets, and they should be ready to adapt quickly.

A key factor is a strong understanding of end-customers and their needs. Developing relationships with these customers can help them survive volatile times and even prosper during downturns. Increasing the use of digital platforms and e-commerce can also reduce intermediary costs and improve communication with customers. In addition, the integration of Industry 4.0 is also modifying the business model for steel producers. For example, German steel manufacturer Feralpi is enabling direct sales to final consumers by establishing new B2C-Business To Consumer channels. This will help the company to avoid intermediaries and improve the quality of its steel.

Market demand

The conventional wisdom in the steel industry today is that adding value, through developing products with advanced metallurgical properties, boosts profitability. However, this strategy is a big investment that requires significant capital and market risk. As a result, it’s important for steel players to keep a close eye on market demand and price trends.

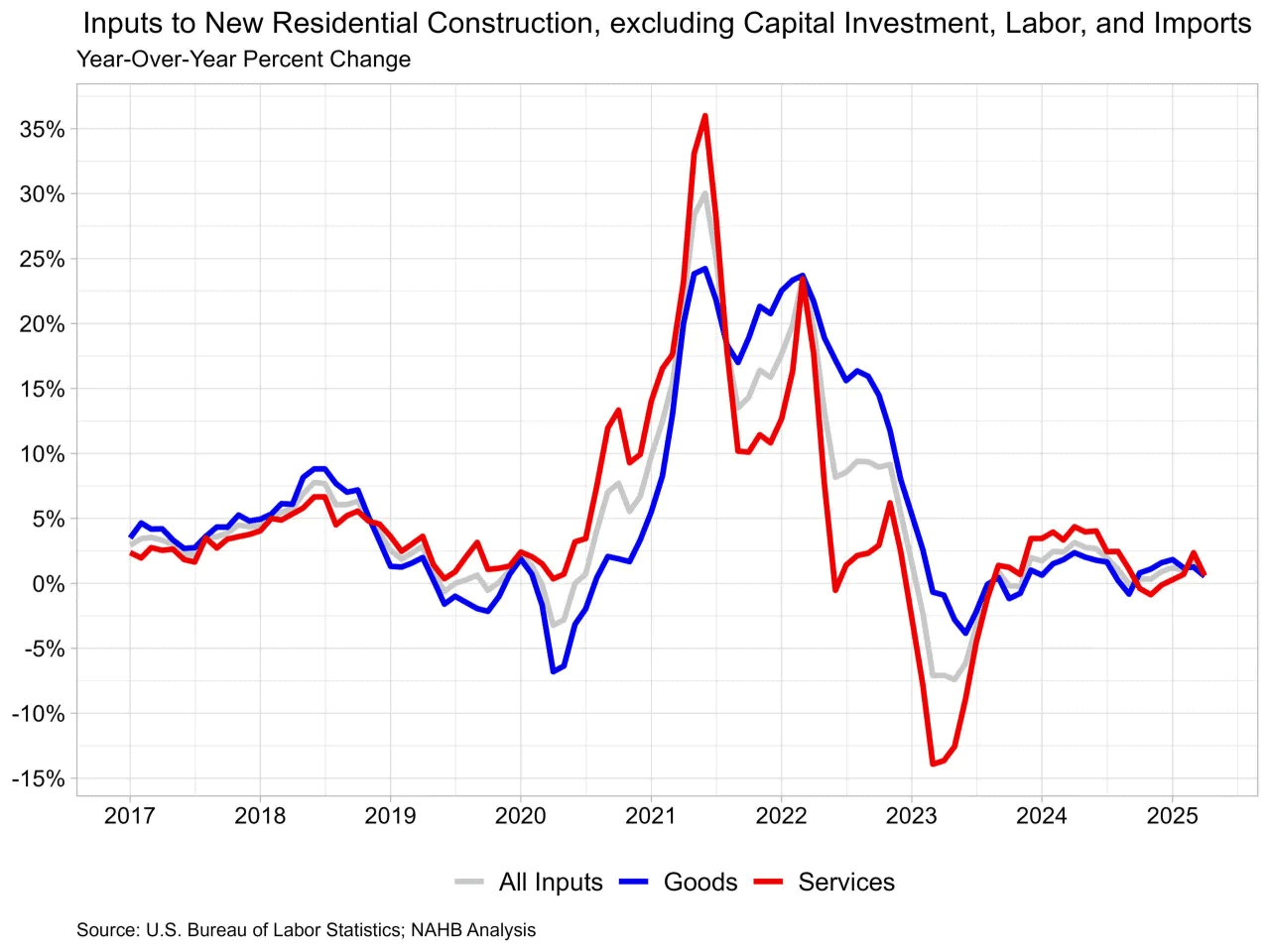

For example, a change in end-customer demand can have a dramatic effect on the bottom line. If building construction activity increases globally, for example, steel demand will increase. This can be caused by economic growth, or more specifically, by rising investments in residential buildings.

In addition, the cost of raw materials continues to rise, so it’s important for companies to be resilient. One way to do this is by investing in operational flexibility, which can help them adapt quickly to changing raw-material prices and supply disruptions. This will also help them maintain healthy margins and reduce the risk of costly shutdowns.

The steel industry is also focusing on sustainability. By implementing Circular Economy practices, they can improve their environmental impact and lower energy costs. This will allow them to be competitive in a growing global market. In addition, it will improve their brand image and attract investors. The key to success for any steel company is identifying and securing critical vendor capacity early, determining how much “cushion” they need in terms of project schedule and budget, and mitigating or transferring delay and cost risks to engineering, procurement, and construction contractors.

Competitiveness

The steel industry is in a constant struggle to boost profitability. This is especially true for European manufacturers, which are focusing on adding value to their product mix in the hopes of leaving commodity-level profits behind. However, concentrating on adding value is risky and requires significant investment and market exposure. This is why many producers are hesitant to take the risk.

Traditional comparisons of domestic profitability, measured as aftertax profits as a percentage of stockholder equity, reveal low steel industry profits compared to other sectors. The steel industry is also a major energy user, with energy costs accounting for a significant share of total manufacturing costs. In the past, a stable natural gas price has been instrumental in boosting steel industry profits by providing cost-effective and predictable energy sourcing.

Investing in production technology and operational flexibility is another way to improve profitability. This strategy allows companies to maintain healthy profit margins even during supply disruptions or when volatility affects raw-material prices disproportionately. Additionally, it allows them to increase resilience and avoid a global short-age of steel products by adjusting capacity quickly when necessary.

Owner’s income

A steel manufacturing business owner’s income varies based on several factors, including market demand, competition, and raw material costs. However, the industry offers a high potential for profitability and long-term success, especially for those who are dedicated to optimizing business operations and investing in growth opportunities. To maximize income, steel business owners should stay aware of regional economic trends and government policies that may impact the industry and regularly reassess their profit margins and operating expenses.

The location of a steel manufacturing business can also play an important role in determining the owner’s income. A region with high market demand for steel products can lead to increased sales volumes and revenue, resulting in higher profits. In addition, a strategically-located steel plant can offer cost advantages by being close to raw materials, transportation infrastructure, and customers.

Large steel manufacturers benefit from economies of scale and efficient production processes, which allow them to enjoy a higher profit margin than smaller businesses. They can also leverage their size to negotiate better prices for raw materials and pass these savings on to consumers. Moreover, they can focus on offering value-added services to their customers to differentiate themselves from competitors. They can also adopt sustainable practices by reducing greenhouse gas emissions, implementing recycling programs, and utilizing renewable energy sources. Moreover, they can explore international markets and export opportunities to increase revenue streams.